To whom does PCI-DSS apply quiz is a comprehensive resource that provides a thorough overview of the Payment Card Industry Data Security Standard (PCI-DSS) and its applicability to various organizations. This quiz is designed to help you determine if your organization is subject to PCI-DSS compliance and provides valuable insights into the key components of the standard.

PCI-DSS is a set of security standards that aim to protect sensitive cardholder data and reduce the risk of data breaches. Understanding who PCI-DSS applies to is crucial for organizations that handle, process, or store cardholder data. This quiz will guide you through the criteria and exceptions to help you determine your compliance obligations.

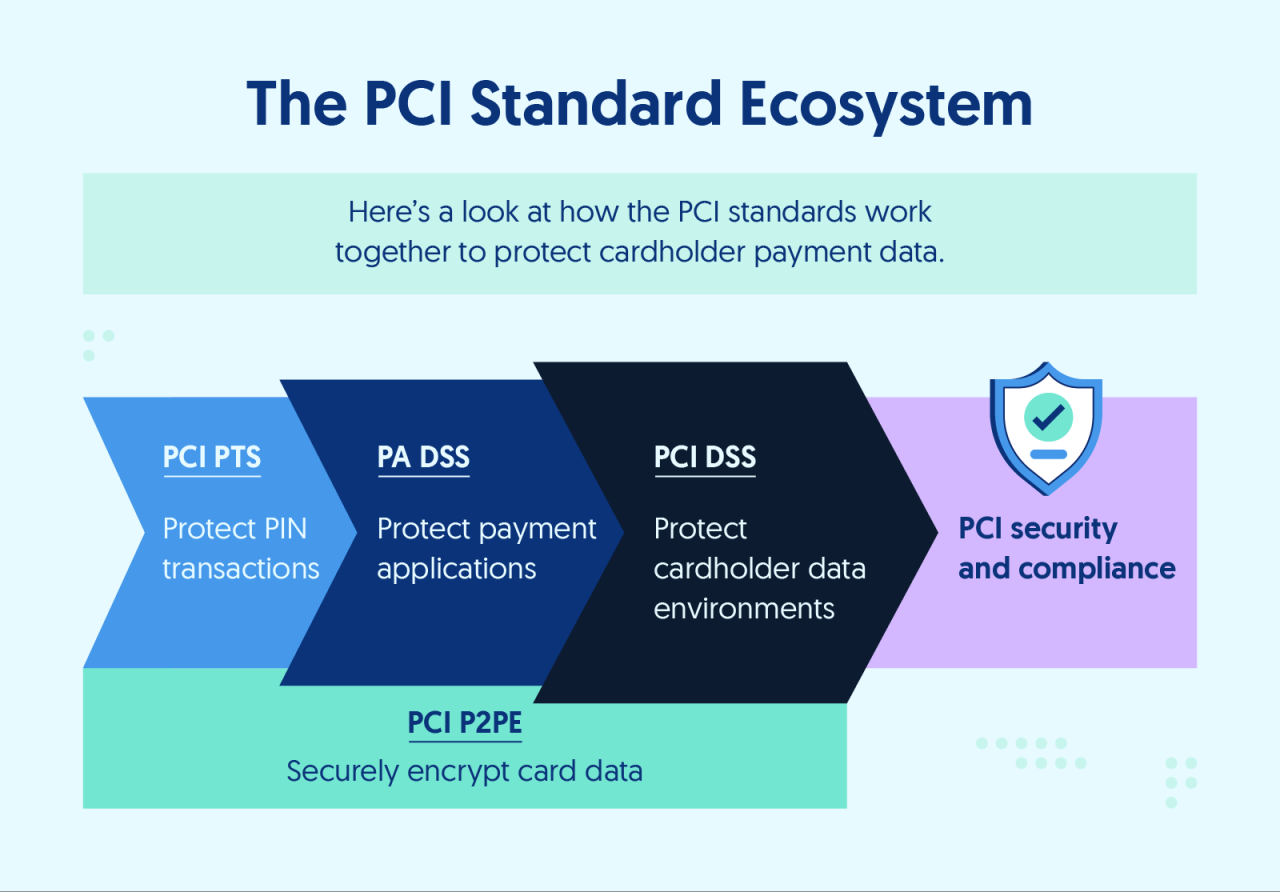

PCI-DSS Overview

PCI-DSS (Payment Card Industry Data Security Standard) is a set of security standards that organizations must follow to protect sensitive cardholder data. It was created by the Payment Card Industry Security Standards Council (PCI SSC), which is a consortium of major credit card companies.PCI-DSS

applies to any organization that stores, processes, or transmits cardholder data. This includes businesses of all sizes, from small businesses to large corporations. The standard is designed to protect cardholder data from theft, fraud, and other security breaches.

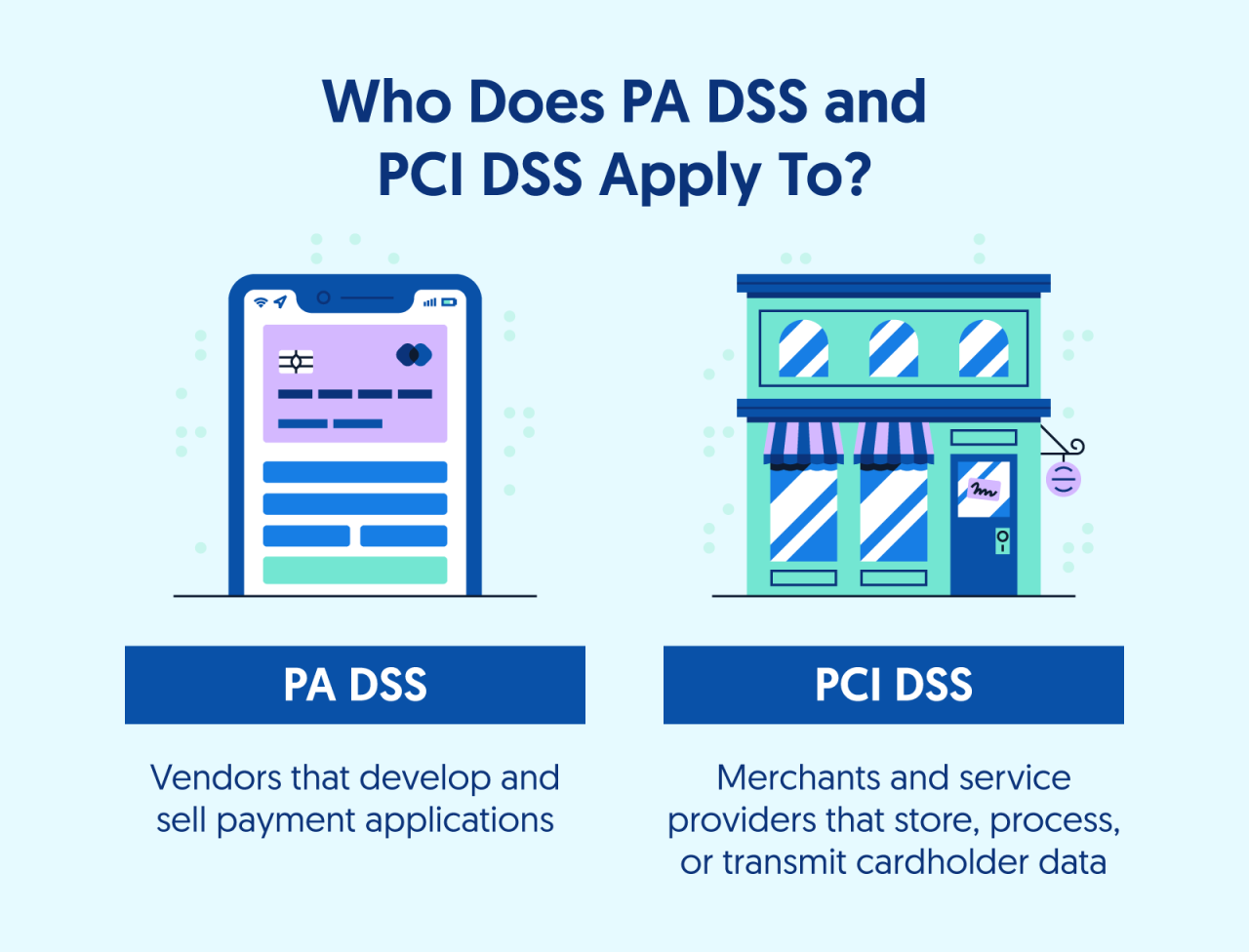

Entities to Whom PCI-DSS Applies: To Whom Does Pci-dss Apply Quiz

PCI-DSS applies to organizations that process, transmit, or store cardholder data as part of their business operations. The criteria for determining if an organization is subject to PCI-DSS include:

- Accepting payment cards directly from customers

- Processing payments on behalf of other businesses (e.g., payment processors, gateways)

- Storing, transmitting, or processing cardholder data

Examples of organizations that are typically required to comply with PCI-DSS include:

- Retailers

- Restaurants

- E-commerce businesses

- Payment processors

- Financial institutions

Exceptions to PCI-DSS Applicability

PCI-DSS applies to organizations that store, process, or transmit cardholder data. However, certain exceptions exist:

Organizations Not Storing Cardholder Data

Organizations that do not store cardholder data are exempt from PCI-DSS compliance. This includes businesses that:

- Only accept payments through third-party processors (e.g., PayPal, Stripe)

- Use point-of-sale (POS) systems that do not retain cardholder data

- Only process transactions over the phone and do not store the data

Organizations Processing Less Than 6 Million Transactions Annually

Organizations that process fewer than 6 million cardholder transactions per year may be exempt from PCI-DSS compliance. However, they are still encouraged to implement security measures to protect cardholder data.

Organizations Operating in Non-PCI Jurisdictions

Organizations operating in jurisdictions where PCI-DSS is not legally required are exempt from compliance. However, it is recommended to adopt security measures to protect cardholder data.

Consequences of Non-Compliance

Failing to comply with PCI-DSS can lead to severe repercussions that impact an organization’s financial standing, reputation, and legal obligations.

Non-compliance can result in:

Financial Risks

- Significant fines imposed by payment card brands and regulatory bodies.

- Increased transaction fees and penalties.

- Loss of revenue due to reputational damage and customer churn.

Reputational Risks

- Damage to brand reputation and loss of customer trust.

- Negative publicity and media scrutiny.

- Loss of market share and competitive advantage.

Legal Risks, To whom does pci-dss apply quiz

- Legal action and lawsuits by affected customers.

- Government investigations and enforcement actions.

- Criminal charges in severe cases.

Examples of Non-Compliance Consequences

- In 2019, Marriott International was fined $123 million for a data breach caused by non-compliance with PCI-DSS.

- In 2016, Yahoo was fined $35 million for a data breach that compromised over 500 million user accounts.

- In 2013, Target Corporation experienced a major data breach that compromised over 40 million customer accounts, leading to significant financial losses and reputational damage.

Implementation and Maintenance of PCI-DSS

PCI-DSS compliance involves a comprehensive process of implementing and maintaining security measures to protect cardholder data. Organizations must follow a structured approach to ensure ongoing compliance.

Steps in PCI-DSS Implementation and Maintenance

- Assessment:Conduct a thorough assessment of your organization’s systems, processes, and infrastructure to identify areas of non-compliance with PCI-DSS requirements.

- Remediation:Address the identified non-compliances by implementing appropriate security measures, such as installing firewalls, updating software, and encrypting data.

- Validation:Conduct regular scans and audits to verify that the implemented security measures are effective and maintain compliance with PCI-DSS requirements.

- Maintenance:Establish ongoing monitoring and maintenance processes to ensure that security measures remain effective and that any changes to systems or processes do not introduce new vulnerabilities.

Roles and Responsibilities in PCI-DSS Compliance

Compliance with PCI-DSS is a shared responsibility involving various stakeholders within an organization:

- Senior Management:Responsible for ensuring that the organization prioritizes PCI-DSS compliance and provides necessary resources.

- Information Security Team:Responsible for developing and implementing security policies and procedures, conducting assessments, and managing compliance efforts.

- Business Units:Responsible for adhering to security policies and procedures, reporting any security incidents, and cooperating with compliance audits.

- Third-Party Vendors:Responsible for ensuring that their services and products comply with PCI-DSS requirements and that they provide support to the organization’s compliance efforts.

Resources for PCI-DSS Compliance

Numerous resources are available to assist organizations in achieving and maintaining PCI-DSS compliance:

- PCI Security Standards Council:Provides official PCI-DSS documentation, guidance, and resources.

- Qualified Security Assessors (QSAs):Independent third-party auditors who can assess an organization’s compliance with PCI-DSS.

- Payment Card Industry (PCI) Data Security Standard (DSS) Compliance Toolkit:A comprehensive guide developed by the PCI Security Standards Council to help organizations comply with PCI-DSS requirements.

Top FAQs

What is the purpose of PCI-DSS?

PCI-DSS is a set of security standards that aim to protect sensitive cardholder data and reduce the risk of data breaches.

Who is required to comply with PCI-DSS?

Any organization that handles, processes, or stores cardholder data is required to comply with PCI-DSS.

What are the consequences of non-compliance with PCI-DSS?

Non-compliance with PCI-DSS can lead to financial penalties, reputational damage, and legal liability.